Startup Sins: We Built a Platform for the Upper Leg of the K (And Laid Off Everyone Else)

A Founder’s Confession in Three Rounds, Plus a Chart That Explains Nothing

By Riggs D. Thermonucleon, MBA (Mythical B.S. Authority),

with compliance notes quietly removed by Legal

The Confession (Every story has one)

I didn’t start out trying to build a company for the upper leg of the K-shaped economy.

It just… happened.

We began with a mission. A real one. Something about “democratizing access,” “empowering users,” and “meeting people where they are.” You know — the phrases that mean nothing until they’re tested by payroll.

Then the market shifted.

Then the investors got nervous.

Then the charts started pointing… upward.

Not for everyone.

Just for the people who mattered.

And suddenly, without anyone saying it out loud, we realized:

the future customer was richer than the present one.

That’s when we pivoted.

Round One:

The Vision (Before the Sort)

At first, we served everyone.

Freelancers

Small businesses

“Creators”

People who paid monthly and asked questions

Our deck said inclusive.

Our roadmap said scale.

Our support inbox said panic.

Revenue grew, but not beautifully. Too many edge cases. Too many users who needed things. Too many humans behaving like humans.

Then an advisor pulled me aside and said the sentence that changed everything:

“You know… your best users don’t actually need support.”

That’s when I saw the K.

Not on a chart.

In the room.

Round Two:

The Pivot (Choosing the Upper Leg)

We didn’t say we were abandoning anyone.

We said we were “focusing on high-intent1 users.”

Which is startup for customers who are:

Wealthier

More stable

Less annoying

Already winning

We removed features quietly.

Then pricing tiers.

Then entire personas.

Support tickets dropped.

Churn improved.

Revenue per user climbed.

Somewhere along the way, we realized the upper leg of the K doesn’t complain — it expects.

And expectations are much easier to monetize than need.

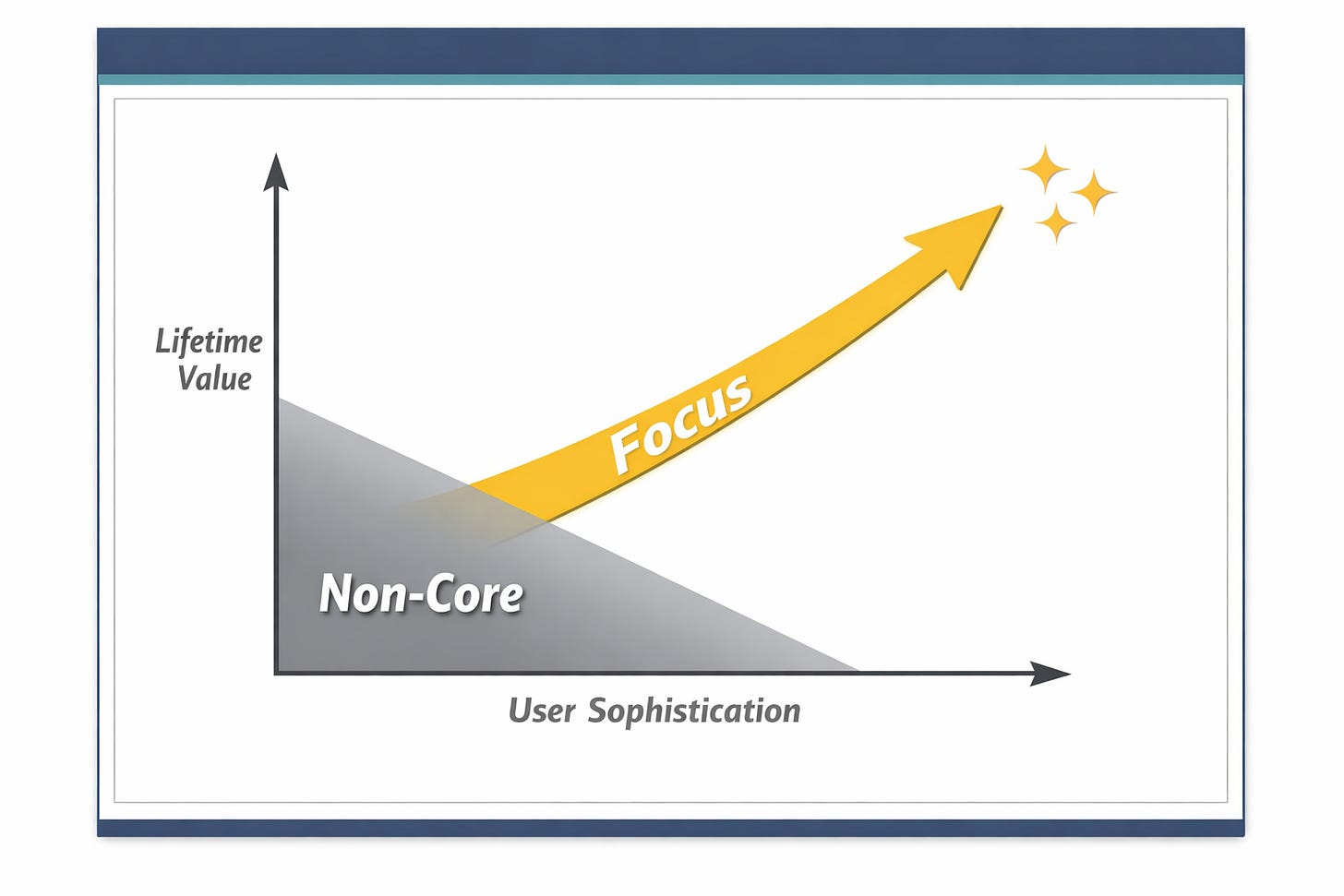

The Chart (Please Clap)

Here’s the chart we showed investors:

X-axis: “User Sophistication”

Y-axis: “Lifetime Value”

A bold upward line labeled Focus

No data labels.

No definitions.

Just vibes.

The lower-left quadrant — where our original users lived — was grayed out and labeled “Non-Core2.”

Not struggling.

Not harmed.

Just… non-core.

Like an organ you can live without.

Round Three:

The Layoffs (Or, “Operational Alignment”)

By the time we laid people off, it felt inevitable.

Support staff first.

Then community.

Then content.

Then anyone whose job involved empathy.

We called it right-sizing3.

We said:

“We’re becoming more efficient”

“We’re aligning with market realities”

“This positions us for long-term resilience”

What we meant was:

“The upper leg doesn’t need you.”

Our remaining employees were thrilled.

The stock price bumped.

The board congratulated us on discipline.

And just like that, the company matched the economy.

A MID-ARTICLE REVEAL: The Moment You Realize You’re Building for Someone Else

If this story feels uncomfortably plausible, that’s because it is.

Startup culture doesn’t create the K-shaped economy — it learns how to surf it.

Paid subscribers get the postmortems, the pattern recognition, and the uncomfortable parallels we don’t publish publicly.

The Euphemisms That Made It Possible

Let’s translate the language that carried us here:

“High-intent users” → People who already have money

“Product-led growth” → Let pricing do the layoffs

“Resilience” → Surviving decisions you didn’t make

“Market discipline” → Someone else absorbs the shock

None of these are lies.

They’re filters.

They separate the upper leg from the lower one and call it strategy.

Did we feel bad?

Briefly.

Then the metrics improved.

And the thing about the upper leg of the K is this:

It rewards amnesia.

If you’re still rising, you don’t have to remember who didn’t make the cut.

The Real Sin (It’s Not the Pivot)

The sin isn’t that we changed direction.

It’s that we pretended the change was neutral.

That the market made us do it.

That no one was pushed — they just “fell outside our ICP4.”

That divergence is natural.

That inequality is efficient.

We didn’t just follow the K-shaped economy.

We productized it.

Tomorrow, in the Mailbag…

Someone will ask whether it’s wrong to be doing well while everyone else is struggling.

Spoiler: the answer will make everyone uncomfortable.

Learn the Game Before You’re “Non-Core”

If startup language keeps rebranding harm as strategy, Riggs University exists to decode it.

Business 101: Business and Economics for the Bold and Brazen teaches you how incentives, markets, and power actually work — not the version from pitch decks.

Understand the system before it sorts you.

Help Us Keep Translating Corporate Euphemisms into English

If this article made you laugh, wince, or forward it to someone who still believes in “mission statements,” consider supporting False Positive Labs.

Your support keeps us independent, underfunded, and irritating to people with decks.

Subscribe: Before You’re Reclassified

Because “Non-Core” Is a Temporary Label Until It’s You

Most people won’t pay.

But subscribing means you’ll see the patterns forming before they’re renamed and normalized.

Share This With Someone Who Says “It’s Just Business”

Friends. Founders. Former coworkers.

Sharing won’t bring the jobs back — but it might retire a euphemism or two.

Confused by the Language?

Visit the Grifter’s Glossary (Now Featuring Startup Alibis)

👉 https://falsepositivelabs.substack.com/p/false-positive-labs-grifters-glossary

⚠️ Mandatory Disclaimer (Still Ignored)

This Is Satire. Do Not Run a Company Based Solely on a Chart Without Labels.

False Positive Labs is a satirical publication. Nothing here is business, legal, financial, or moral advice. If you recognized your company in this article, that’s between you and your conscience — not us.

High-Intent User: Someone whose income insulates your roadmap.

Non-Core: Human beings rendered optional by PowerPoint.

Right-Sizing: Firing people until the chart feels calm again

ICP (Ideal Customer Profile): A carefully researched fiction describing the kind of user your company wishes it had — typically wealthier, calmer, less demanding, and mysteriously aligned with investor expectations. Often used to justify ignoring existing customers while claiming it’s “strategic focus,” not abandonment.